working capital funding gap in days

The REIer just has to make sure they have already-lined-up exit-strategy money to get EMD Funding out of the deal in a timely fashion. The company receives payment fro.

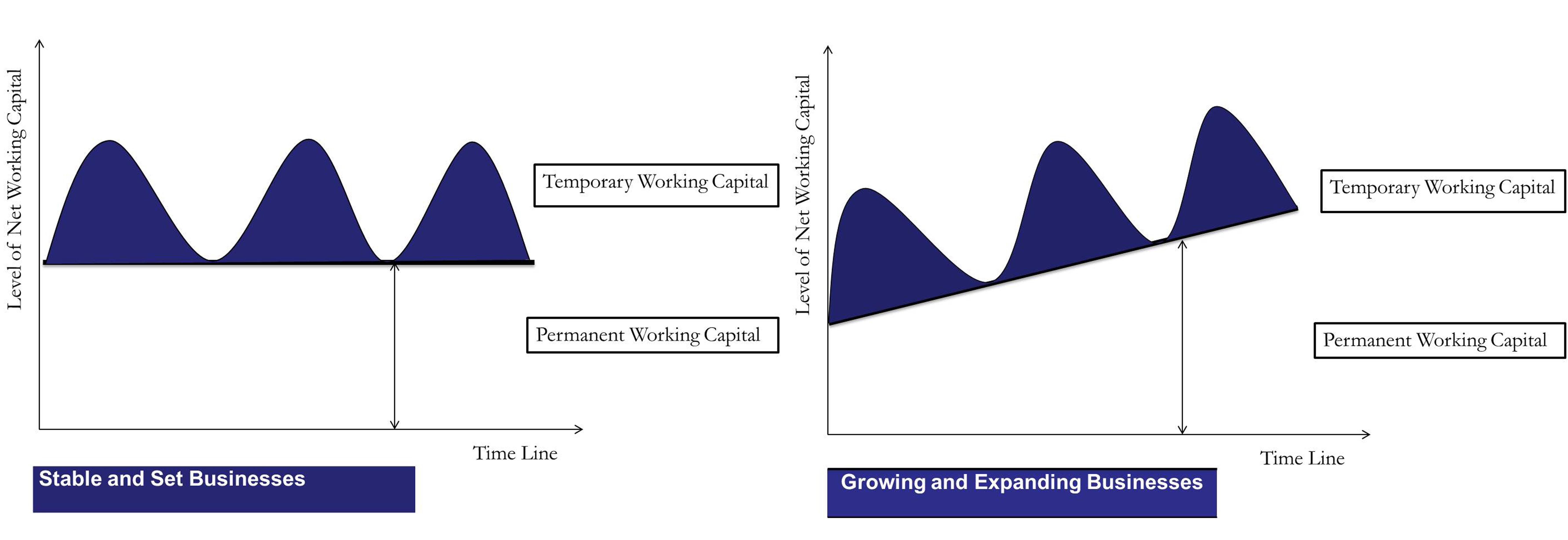

Permanent working capital Working capital funding 20000 Finance cost 7 x 20000 1400 Temporary working capital Average working capital funding 25000 2 12500 Finance cost 5 x 12500 625 Total finance cost 1400 625 2025.

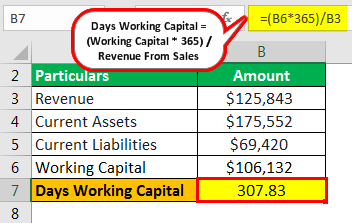

. The days working capital is calculated by 200000 or working capital x 365 10000000 Days working capital 73 days However if the company made 12 million in sales and working capital. Cash short term investments short term debt Working capital requirements are an investment WC. Working Capital Current Assets Current Liabilities The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off.

The ideal ratio should be 2 is to 1 in the case of manufacturing companies. Shrinking the cash gap is good for the bottom line. This is the vehicle that allows YOU the real estate.

According to experts one of. This leads to extra costs thereby reducing the. The concept gap funding is the critical component for the term other peoples money or OPM.

This will also be the one for you to use in paying for supplies rent and salaries as well. The working capital gap is 100-6040 The net capital gap is long term sources of the company less long term uses of the company. According to Merriam Webster 1.

Working capital funding gap refers to a gap that exists when the amount of money that is needed to fund ongoing operations or the future development of the business is not currently funded with debt cash or equity this gap can be reduced by increasing the payables period. It shows how long cash is tied up in the companies working capital. Save an investor-owned.

365 413 361 583 329 Based on the information below how much does the company need to finance the working. Or increasing inventory turnover. The amount of finance a business needed to carry out this day to day trading activity is referred to as the working capital requirement or working capital funding gap and varies from industry to industry depending on the amount of time the business takes to pay suppliers the amount of inventory held and the time it takes to collect cash from customers.

According to a recent working capital practices study of the manufacturing and distribution industry 161 percent of accounts receivable are still in the bush 180 days after the sale is made. The cash gap drops to only 40 days even if management does nothing to change the collection or payables periods. In these 30 days the company has to meet the day-to-day operational expenses by means of short-term borrowings which attract certain interests.

The higher the number of days the longer it takes for that company to convert to revenue. The company sells its inventory in 85 days on average inventory days. The intricacies of financing real estate projects for a profit can be somewhat unclear especially for a new investor.

In some businesses especially to those who sell goods a large portion of the working capital is allotted to the prices of the products sold. Lets say that the company XYZ has to pay its suppliers in 30 days but collects its receivables from customers in 60 days. It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling What is Financial Modeling Financial modeling is performed in Excel to forecast a.

200000 572 319 O 684 o 438 Whats the companys working capital funding gap in days based on the information below. Not only is there an opportunity cost associated with extended credit sales but you incur interest for financing the loan to your customer. 345 Payable days.

The entire reduction stems from better inventory control. Working Capital Days Receivable Days Inventory Days Payable Days. Flip Gap First Position Funding.

A Valuation multiples b Transaction. The company purchases on credit materials to manufacture a product. 472 Inventory days.

Working Capital is derived from existing assets by subtracting the total liabilities. Take 360 days in your calculation. Eleven Best Ways to Improve Working Capital Working capital is vital for the day-to-day operations of a company such as procuring raw materials payment of wages salaries and overheads and making sure that production matches demand among other key objectives.

456 Days in the period. A companys capital is used in its day-to-day operating activities measured as the existing assets minus the current assets. For example they have 90 days to pay for the raw materials payable days.

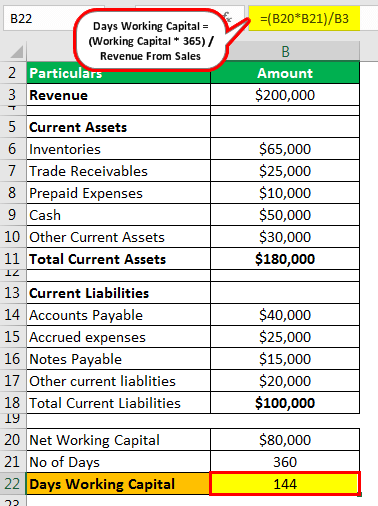

This ratio measures how efficiently a company is able to convert its working capital into revenue. Solution Below is given data Calculation of Net Working Capital 180000-100000 Net Working Capital 80000 Calculation of Days Working Capital 80000360200000 144 days. Working capital Working Capital Current Assets - Current Liabilities Cash conversion cycle.

This ratio shows that the company has enough funds to support its short-term debt. For most companies the working capital cycle works as follows. Up to 90 Days Up to 99k.

However a capital-intensive company will have a different ratio and in the case of. It is the working capital that funds the price of the materials and the labor into the service you render or the products you sell. A working capital formula determines the financial health of the business and it suggests how the profitability can be increased in the future through the current ratio which we get by dividing current assets by current liabilities.

Even if the terms are equal there could still be gaps or delays between the time an expense incurred needs to be paid and when the revenues related to the incurred expense get collected. Three main ways investors use Flip Gap First Position Funding to their advantage. Accounts Receivable Inventory Accounts Payable Other.

Quickly flip a propertyor fixflip or buyholdif the math works out OK. Question Calculate accounts receivable days based on the information below. That is why companies are constantly looking for ways to improve their working capital position.

For instance if your supplier terms are 30 days and your customer terms are 60 days you will have a cash flow gap to fill with some form of working capital financing. It means the surplus in long term sources like owners capital and term loans less long term uses like Fixed Assets miscellaneous and Non-current Assets Intangible Assets. This inventory reduction leads directly to a drop in annual interest cost of 48 million 50 days 3 96000 per day.

Therefore having a working capital cycle of 30 days. The concept of gap-funding was introduced to me in my early days as a real estate investor. View Questio4docx from A46 410V at Washington University in St.

Days Working Capital Definition Formula How To Calculate

Efficiency Ratios Overview Uses In Financial Analysis Examples

Days Working Capital Definition Formula How To Calculate

Working Capital Cycle What Is It With Calculation

Working Capital Formula Youtube

Days Working Capital Definition Formula How To Calculate

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

Working Capital Cycle Definition How To Calculate

Cash Conversion Cycle Formula And Excel Calculator

What Is Working Capital Gap Banking School

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Types Of Working Capital Gross Net Temporary Permanent Efm

Temporary Or Variable Working Capital

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Cycle Understanding The Working Capital Cycle

As The Venture Capital Game Gets Bigger The Midwest Keeps Missing Out

Working Capital Cycle Understanding The Working Capital Cycle

Days Working Capital Formula Calculate Example Investor S Analysis

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)